Seven

Build activity system

Toly Bread

growing into Chinese Yamazaki with daily delivery of fresh bread

“Strategy is not just about establishing a competitive advantage; it is also about maintaining that advantage.”

⸺Michael Porter.

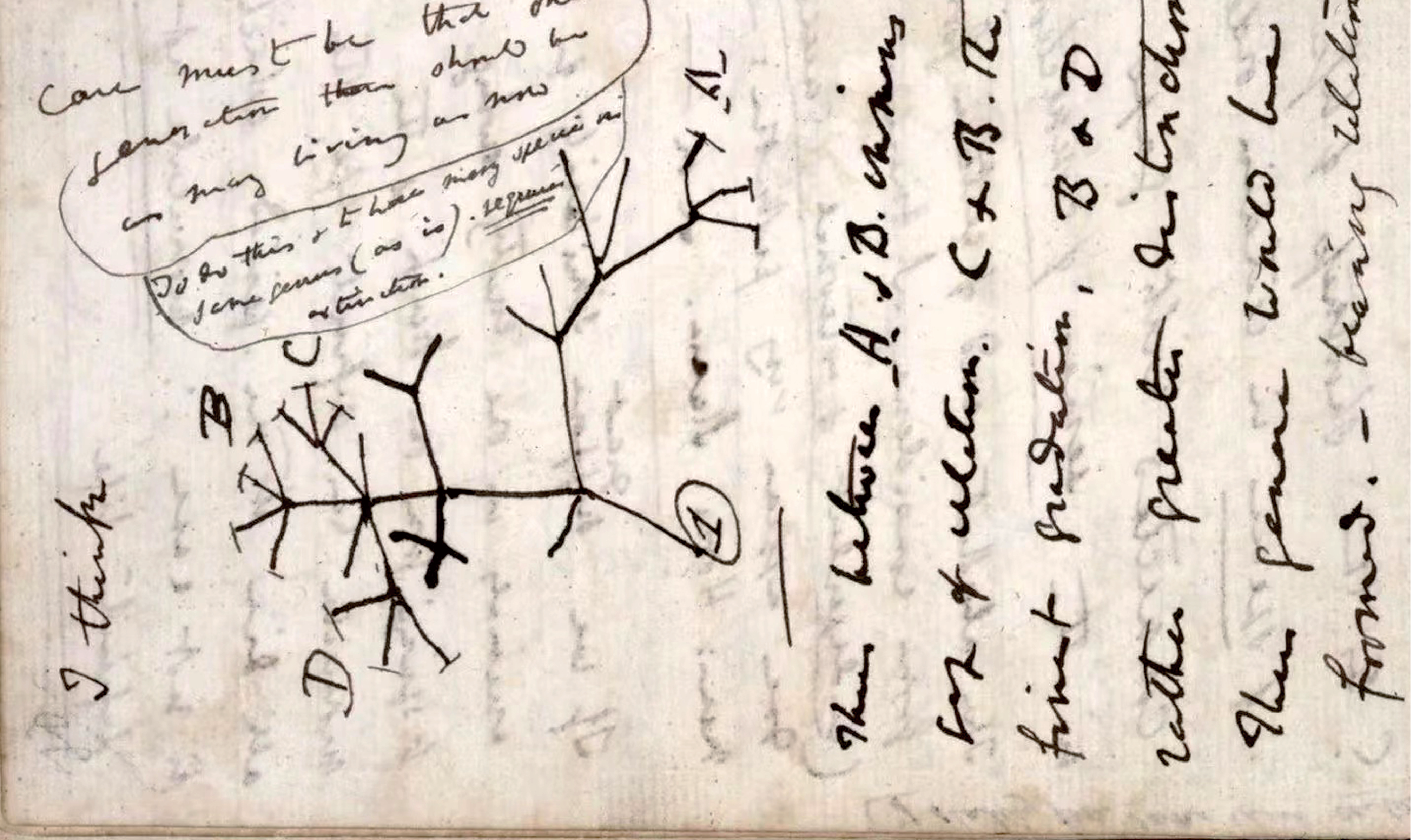

Innovation often comes from subtle details. In order to transform these small innovations into game-changing ones, companies need to create fit among their activities. Strategic fit is the most critical element in creating the competitive advantages, as the system create an interconnected and tightly linked chain that keeps followers out of the loop. There are three types of fit. First-order fit is simple consistency between each activity (function) and the overall strategy. Second-order fit occurs when activities are reinforcing. Third-order fit goes beyond activity reinforcement to what Michael Porter calls optimization effort. In all three types of fit, the whole matters more than any individual part. Competitors can quickly imitate an individual activity, for example special sales model, production techniques or product performance, but they can’t imitate the entire interconnected activity system.

Illustration 7.1 Southwest Airline’s Low-Cost Activity System

The “Fresh Bakery and Direct Delivery” Model of Yamazaki Baking in Japan

Founded in 1948, Yamazaki Baking Company has created the short-shelf-life packaged bread category in Japan and pioneered in the innovative “fresh bakery and direct delivery” model, providing short-shelf-life bread to various retailing channels such as convenience stores and supermarkets. In 2012, Yamazaki Baking's revenue reached 24.6 billion yuan. Owning over 40% market share, Yamazaki is definitely the market leader of packaged bread in Japan.

Yamazaki Baking’s factories are usually located in suburban areas of the cities, where bread is produced and processed through assembly lines and modern equipment. Taking the factories as the center, products are distributed to local or nearby shopping malls, convenience stores or dealers through centralized logistics. Normally Japanese consumers can buy Yamazaki bread from convenience store just a few hours after being produced. Under the model of “central factory baking and direct delivery to points of sales”, the company has the advantage of economies of scale: streamlined products with the pursuit of single-product production, scale and costs reduction; direct to sales terminals such as supermarkets with a significant drop of its sales costs. For consumers, they get the dual benefits of enjoying the fresh taste bread as good as in bakery stores yet paying at a much lower prie.

Activity System on the “Fresh Bakery and Direct Delivery” Model

Yamazaki Baking has built an interconnected activity system on the Fresh Bakery and Direct Delivery model.

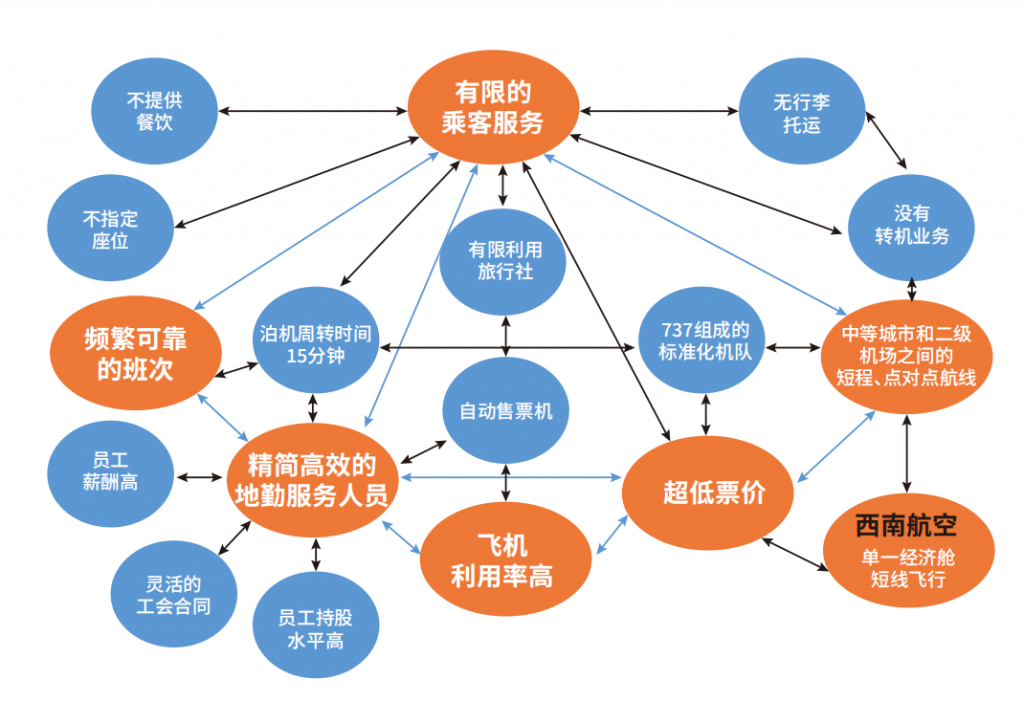

Firstly, it built its own factories and expanded step by step. From 1948 to 1966, taking Tokyo as the base, Yamazaki Baking constructed and operated factories in Ryogoku, Yokohama and Suginami, fortifying its leading position in Kanto Area. In 1966, it opened a factory in Osaka, entering the Kansai market. By 1980, Yamazaki had built 16 factories in key cities in Kansai, Chubu, Chugoku, Kyushu and Tohoku, gradually achieving geographic expansion and nationwide coverage. Currently Yamazaki has 27 factories in Japan. Over the past 18 years, Yamazaki focused on the Kanto market, the biggest one in terms of economy scale, and had high level of share of mind. Meanwhile, it owned a leading market share through its principle market to provide stable profits to fuel its national expansion.

Illustration 7.2 1984-2000 The Factory Expansion of Yamazaki Baking

Secondly, it expanded its sales network. Yamazaki's channels include convenience stores, supermarkets and many other retail terminals. The fast-growing number of convenience stores, represented by 7-11, Family Mart and Lawson, had also brought an increased number of points of sales for Yamazaki. Yamazaki has always insisted on manufacturing and providing bakery products to convenience stores with its own brand rather than through third parties. By 2010, Yamazaki had 97,000 retail terminals in Japan, selling freshly baked bread and delivering directly from its factories every day.

Thirdly, it created the daily delivery logistic system. Behind the “Fresh Bakery and Direct Delivery” system is Yamazaki's powerful logistics and distribution network. In 2001, Yamazaki started to build its own logistics company. It also built distribution and logistics centers nearby the factories. In 2012, Yamazaki's logistic footprint expanded to 15 locations across Japan, with 15 distribution centers, 2 vehicle factories and 2,600 trucks, delivering to 100,000 stores every day, with even up to two to three deliveries per day for some stores. The workflow of Yamazaki's trucks is well standardized. A truck will deliver to around 50 stores before the convenience stores start selling breakfast with bread: departing from the factory at 2 a.m., delivering to a store every 5 to 10 minutes, and finishing all deliveries around 5 a.m. After delivering the bread in the early morning, the truck returns to the factory to refill with new products for another round of delivery. From 8 a.m. to 11 a.m., the truck completes its second round of delivery. The truck continues its third round of delivery during 2 p.m to 5 p.m.. The frequency of three deliveries per day enables consumers to enjoy fresh and best-value-for-money bread at key meal occasions in the morning, at noon and in the evening, which also further promotes the adoption of bread into meals in Japan, helping Yamazaki to enlarge the market size of the packaged bread category.

Toly Bread, the Chinese Yamazaki

Due to the vast geography scope of China, the lagging behind cold chain logistic infrastructure and strict requirements of food quality, the packaged bread market is dominated by ambient long-shelf-life products. Dali and Panpan, both located in Quanzhou, Fujian Province, are the leading brands in this category. However, with the improvement of people’s living standards and awareness of health, the consumer demand for fresh and short-shelf-life packaged bread has emerged. In 2012, we aided Toly Bread in propelling short-shelf-life packaged bread in China.

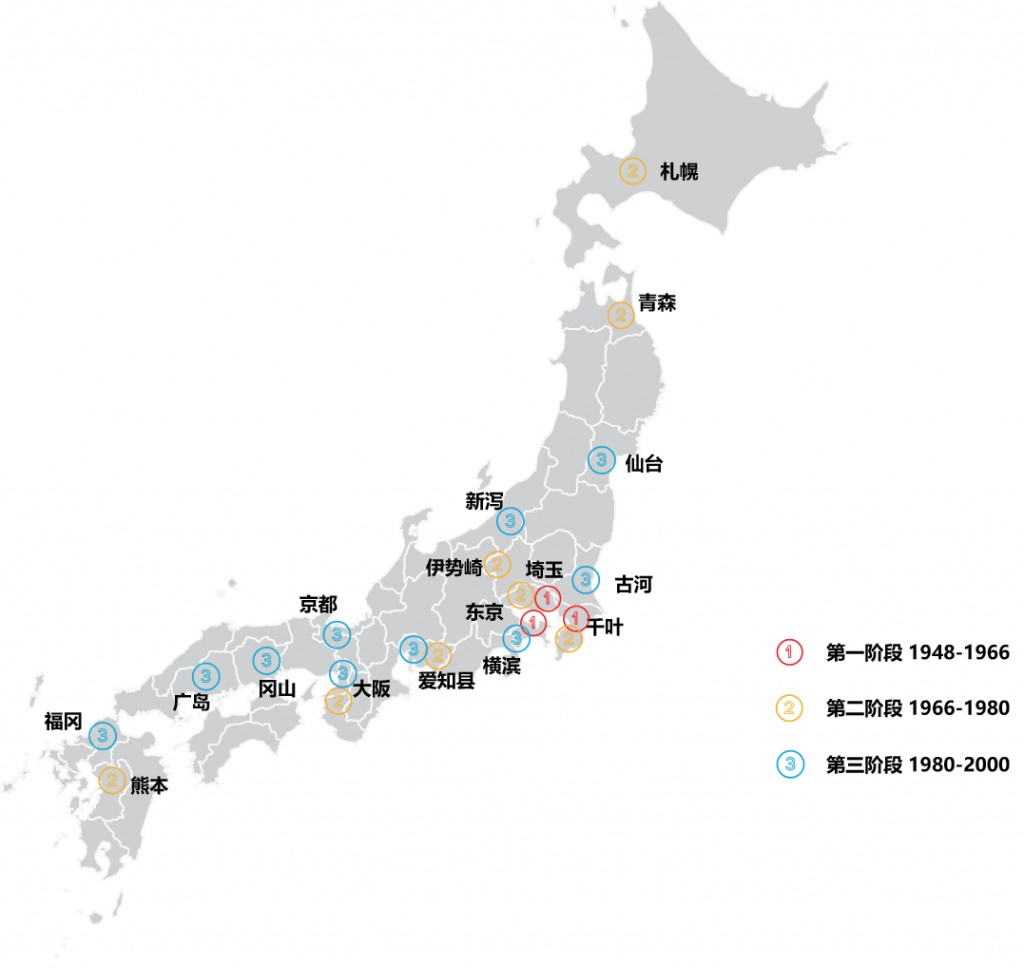

Firstly, starting from consumers’ perception, we communicated with effective brand positioning with more extensive education to consumers.

The best positioning for a new category is to take the most important attribute, such as “Nnongfu Spring, a little bit sweet”, “Every drop of Luhua oil spreads the fragrance to thousands of households”. In consumers’ mind, comparing with the long-shelf-life packaged bread, the No.1 attribute of the short-shelf-life one is freshness. Hence, we helped Toly Bread to create the brand positioning – “Toly Bread, daily delivery of fresh bread – providing fresh bread to millions of consumers national wide”. In terms of communication touch-points, we recommended Toly Bread focus on offline by leveraging the closets touch-points with consumers, such as product packages, shelves and transportation trucks.

Illustration 7.3 The Brand Positioning of Toly Bread

Secondly, we focused on best-selling core products.

Under the central factory model, streamlining the product portfolio helps to reduce the difficulty of product sorting and shipment, and helps the factory further expand economies of scale and reduce costs. More importantly, focusing on best-selling core products is easier for consumers to connect the new category with the brand in their mind. To ensure that the brand stand for the most valuable part of the category, the best-selling core products should appeal to mainstream consumers.

Through our consumer studies, we came up with a clear picture of product portfolio of Toly Bread. On one hand, we streamlined the product lines by gradually discontinuing the long-shelf-life ones. On the other hand, based on the consumers’ criteria of product segmentation and product retail sales value, we focused on key brands Mini Red Bean Bun and Chunshu Sliced Bread. Besides, each region, province or city can complete its own product portfolio basing on local popular flavors.

Thirdly, we recommended build a daily delivery logistics system.

During that time, nationwide competitors Mankattan and Bimbo mainly sold products with a shelf life of 14 days, and the delivery frequency was usually every 3-4 days. Toly Bread’s delivery frequency was about every two days in the Northeast region. We suggested learning from Yamazaki Baking to increase the delivery frequency to further advocate its standpoint against the long-shelf-life bread and raise the bar for competition.

In 2012, Toly Bread piloted daily delivery in the Northeast market, transforming from two-day delivery to daily delivery. Taking its biggest market Shenyang city as an example, the weight of daily delivery reached 30% and that of two-day delivery reached 60%. The result was amazing. Among the 180 stores piloting daily delivery, 80% achieved growth versus previous month, with a significant growth rate up to 127%. In the cities where the competition was very intense, the daily delivery helped Toly Bread to pull ahead of its competitors.

Lastly, we designed the market expansion plan: from point to line, from line to area.

Due to some historical reasons, Toly Bread didn’t have a universal strategy in market expansion and development. Toly Bread had certain competitive advantages in the overall Northeast market, unfortunately the advantages were scattered in many different areas. We urged Toly Bread to follow the way how champagne tower works: focusing on markets where they have competitive advantages with increased investments in resources in order to become the dominating brand in terms of share of shelf and share of mind; leveraging the achieved and cumulated competitive advantages in those markets to penetrate into neighboring areas.

Taking the factories in the Northeast Region as the foundation, Toly Bread expanded its footprints into all untapped markets, covering all cities and counties. Meanwhile, it created a connected network with Beijing, the North and Northeast China combined, which served as the base for further expansion. Sequentially, Toly Bread started to enter into Central and East China by constructing new factories, building sales networks and promoting the category and brand. Eventually, Toly Bread would expand to the South and Southwest China to achieve the national coverage.

Illustration 7.4 Champagne Tower

Since 2012, after a decade of development, Toly has become the market leader in China’s short-shelf-life packaged bread category, with a revenue of 6.335 billion yuan in 2021. It owns 20 factories and 260,000 points of sales across China. Following Toly Bread, the manufacturers of long-shelf-life packaged bread entered the short-shelf-life packaged bread category. Panpan introduced the Lingxian (leading fresh) brand in 2016, while Dali launched the Meibeichen brand in 2018. The short-shelf-life packaged bread category is thriving.