Nine

Diverge

Meiyijia

creating the second growth curve by incubating private label brands

“The Tao produces one, one produces two, two produce three, and three produce all things.”

⸺Lao Zi

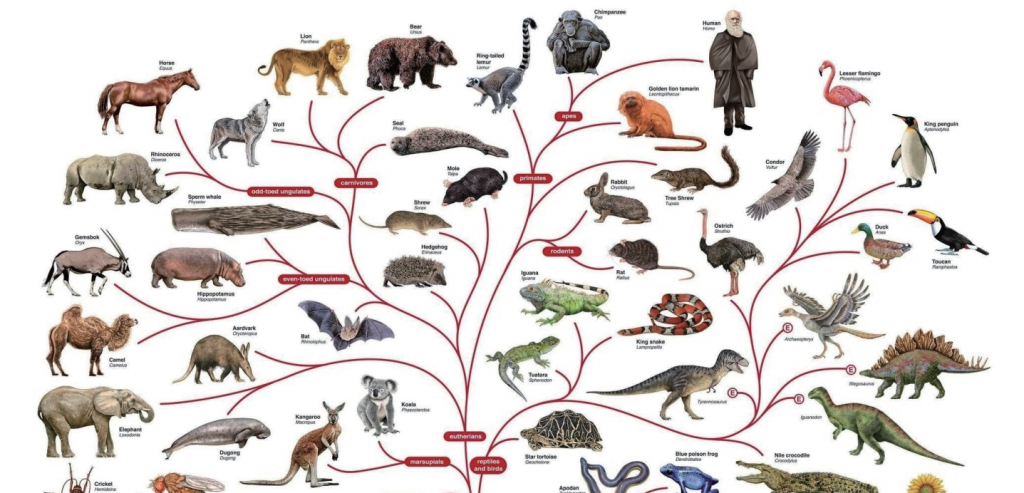

Over billions of years of evolution in nature, from the primitive single-cell organisms to the countless diverse species of today, the main reason behind this diversity is the divergence of species. Species diverge to create new species.

Illustration 9.1 Darwin’s Principle of Divergence

In the business world, categories diverge to create new categories, providing infinite opportunities for new brands.

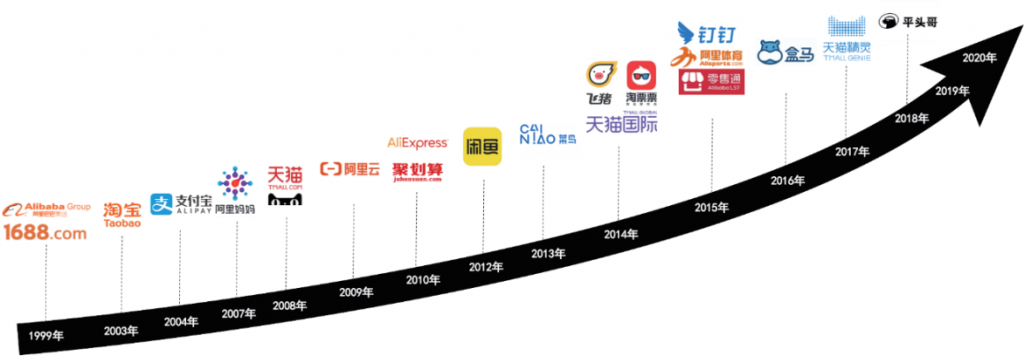

Illustration 9.2 Alibaba Growing with New Categories and Brands

7-Eleven, the King of New Generation of Retailing in Japan

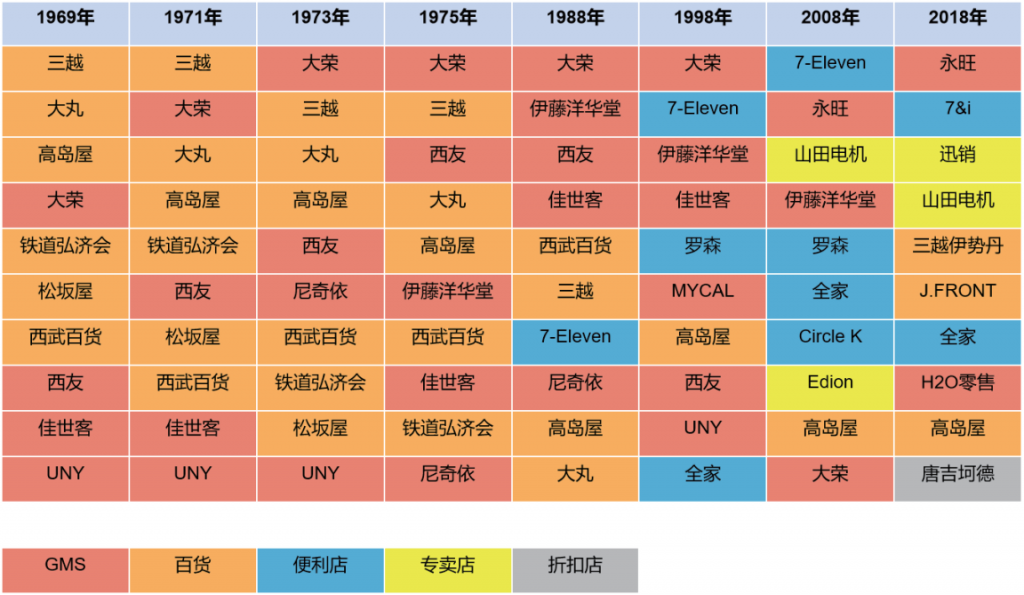

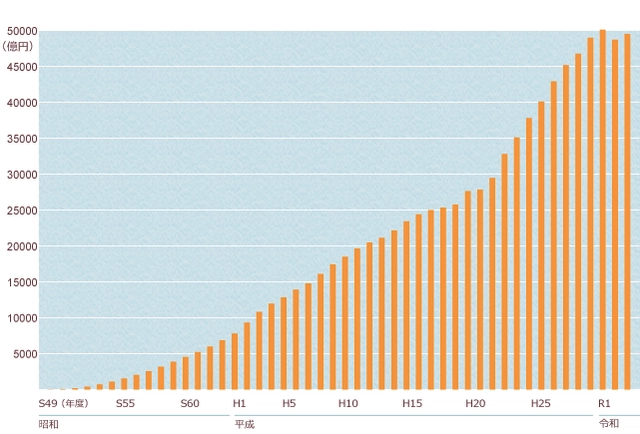

Over the past 50 years of development in the Japanese retail industry, there were three major different stages: the stage dominated by department stores, the state dominated by hypermarkets and supermarkets, and the stage dominated by convenience stores. The convenience store appeared last but grew the fastest.

Illustration 9.3 1969-2018 The Sales Value Ranking by Retailers

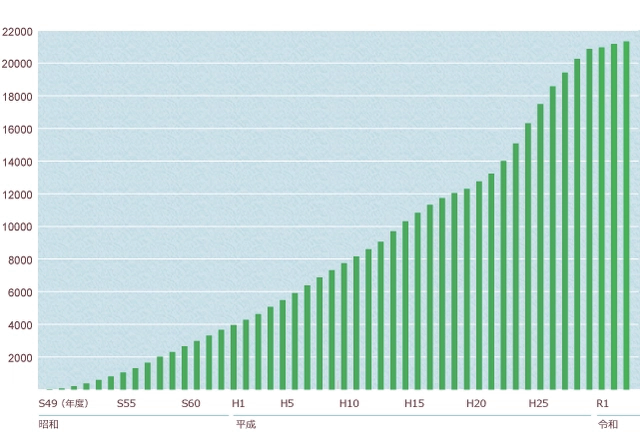

Since its first convenience store in 1974, 7-Eleven has become the king of Japanese convenience stores after 50 years of development.

Illustration 9.4 1974-2021 Number of Convenience Stores of 7-Eleven in Japan

Illustration 9.5 1974-2021 Revenue of 7-Eleven in Japan

“Convenience” is the most important attribute of a convenience store and 7-Eleven has always put “convenience” above all. When entering the Japanese market, longer opening hours was perceived as convenience, 7-Eleven was run as 24-hour store. With the intensified situation of population aging in Japan, many seniors have difficulties in going out. In 2000, 7-Eleven launched its Seven Meal home delivery service. In 2001, 7-Eleven Bank was introduced. During that time, Japanese banks closed at 3 p.m. in the afternoon and requested customers to dress formally (otherwise would not be allowed to enter). 7-Eleven Bank was 24-hour in-store service. Customers could withdraw money anytime without any dressing requirements.

The installation of ATMs had brought surprising derivative effects for the stores, as most customers who came to withdraw money would also buy something. In fact, many other services also played critical roles in attracting traffic, such as Seven Spot Free WiFi, public utility bills (e.g. water, electricity and gas), tax payment and printing.

Despite of all the convenient services, 7-Eleven still relies on selling products to make money. Besides of selling national brands, 7-Eleven started to sell its private owned brand Seven Premium in 2007.

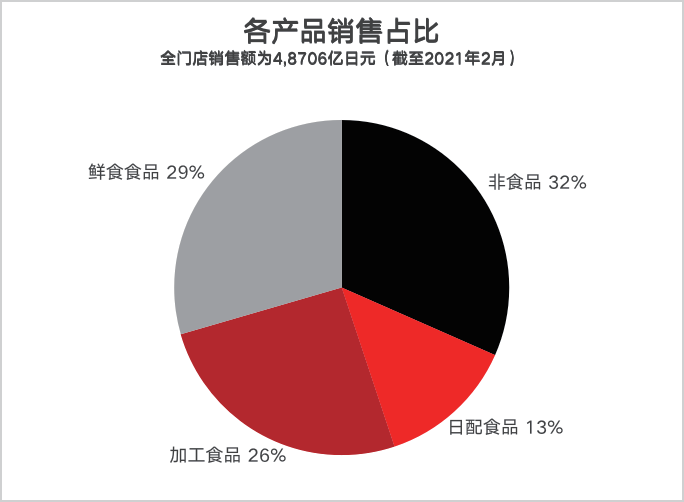

“Seven Premium” initially had only 49 products. By 2014, it owned more than 1,700 ones. By 2019, it had even expanded to include 4 major categories of fresh food, staple food, processed food and non-food with a total of 4,150 products. Seven Premium contributed 80 billion yen in sales to 7-Eleven in its first year, and reached 1.46 trillion yen by 2020.

Illustration 9.6 The Product Contribution of Seven Premium

Illustration 9.7 2007-2020 The Revenue of Seven Premium

Meiyijia, the King of Convenience Store in China

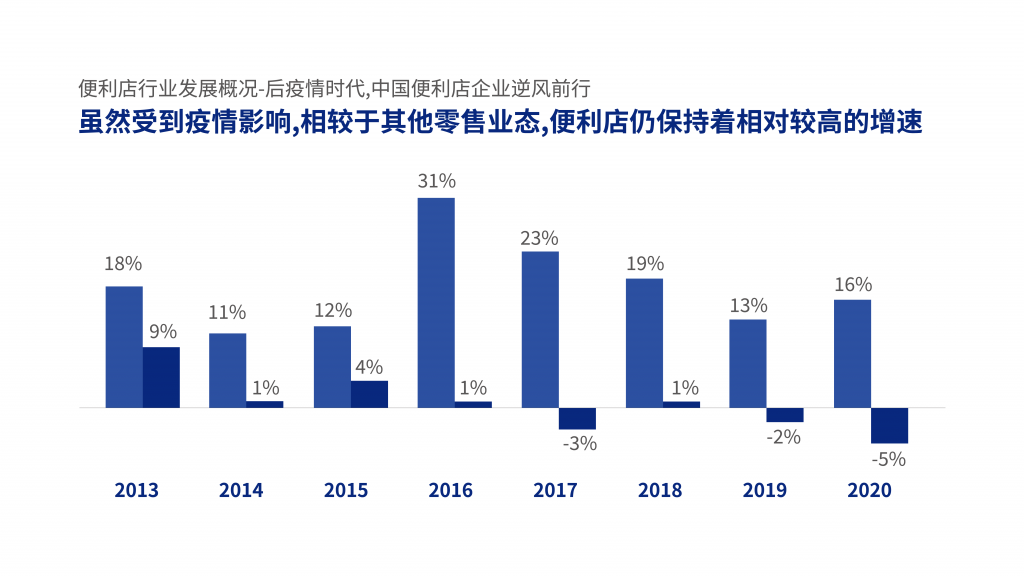

Currently, China’s convenience store industry is at a level similar to that of Japan in the 1990s. According to data from the China Chain Store & Franchise Association, the number of convenience stores nationwide reached 253,000 in 2021, an increase of 60,000 compared to 2020 with a year-on-year growth of 31%. The total number of retail stores in China is about 6 million with chain convenience store contributing less than 5%. Chinese convenience store still has huge room to grow.

图9.8 2013年-2020年中国实体零售额增速

Unlike Japan where the convenience store industry is equally led by 7-Eleven, FamilyMart and Lawson, Meiyijia is dominating in China with over 30,000 stores across 20 provinces and cities. We collaborated with Meiyijia to develop its private label brands and products in 2020.

Chunhuan Spring Water at 1 yuan

The first private label product we worked with Meiyijia was bottled water. Many categories of China's soft drink industry have already stagnated or even declined, but bottled water still has an annual growth rate of nearly double digits. Millions of Chinese households are still in the trading up transition of drinking boiled tap water or jug water to drink bottled water. Consumers have enormous demands for economy bottled water such as Jinmailang soft purified water. With over 20 years of communication and education of “a little bit sweet” and “transporters of natural resources”, Nongfu Spring successfully built the perception in consumers’ mind that natural water and spring water are as good as natural mineral water. In fact, natural mineral water has independent national standards, requiring a certain level of specific mineral content in the water source. Generally speaking, manufacturers need to pay higher production costs. Meanwhile, the production cost of natural water is almost the same as that of purified water.

Taking above information into consideration, we recommended Meiyijia launch a natural water brand called "Chunhuan Spring” sourcing from the famous Lianhuashan Forest Park in Shanwei, Guangdong province. The core item of Chuanhuan Spring is not the single count 555ml; instead it is the 6 counts of 555ml (555ml*6) selling at 5.99 yuan, which is the only item selling less than 1 yuan per bottle in the convenience store in Guangdong. Thanks to the positive perception of natural water and its best value for money, Chuanhuan Spring had monthly sales over 1 million yuan just 3 months after its debut without any additional promotion resources.

Illustration 9.9 Meiyijia Chunyuan Spring Natural Water

Xianjiaolasong Bread (bread with fresh pepper and spicy meat floss)

In 2021, Meiyijia Central China Bakery Factory was established, located in Changsha, Hunan province, with the objectives of providing bakery products to thousands of stores in Hunan, Hubei and Jiangxi provinces.

We conducted field researches in above three provinces, covering capital cities, prefecture-level cities, county-level cities, villages and towns. We collected data based on thousands of bread samples. We spotted the “greatest common divisor” of the total market — the most widely accepted bread categories and their pack formats and prices. Meanwhile, we fully leveraged the experience of experts in the bakery factory and market insights to give recommendations of innovative products.

In early 2022, fresh short-shelf-life packaged bread, manufactured by Meiyijia Central China Bakery Factory, hit the shelves of thousands of stores in those three provinces. Products such as the "Caterpillar Bread”, “Pure Cake” and “Coconut Fruit Bread” are widely and well received by and becoming essential for almost all different groups of consumers. The outstanding market performance of those products generated stable revenues.

One particular item impressed consumers deeply — Xianjiaolasong Bread (bread with fresh pepper and spicy meat floss). With consumer studies, we had already learned that Meiyijia would need bakery products with “real meats” inside, such as meat floss bun and hot dog bun. With above consumer insights, experts in the factory proposed that they could add some peppers to the meat floss to create a spicy flavor catering to the majority of people in these three Central China provinces. To emphasize the freshness of bread, Meiyijia added with fresh peppers instead of cheaper dry ones. Sequentially, a bread with “real pepper real meat floss, happiness in each bite” was born. This bread was the best-selling one for over 10 weeks since its launch, becoming the iconic “exclusive and best value product” of Meiyijia bakery business.

Illustration 9.10 Bread Shelf in Meiyijia Store

28-Day Fresh Beer (fresh beer with as short as 28-day shelf life)

Over the past decade, the Chinese beer market has demonstrated the trend of consumption trading up with a decrease in volume and an increase in price. Fresh beer is one of the most important strategic directions. Hence, we partnered with Meiyiji introduce its private label brand 28-Day Fresh Beer with the shelf life as short as 28 days, with full cold chain transportation from factory to store.

In order to communicate the differentiations between fresh beer and regular beer as much as possible, we highlighted the brand name 28-Day Fresh Beer on the packaging as big as possible. We chose the large size 650ml tinplate can as the format, making it easier to be noticed among the leading brands’ 350ml and 500ml formats in the freezer.

Considering the fierce competition and high cost of gaining spaces in the freezer aisle, Meiyijia 28-Day Fresh Beer only focused on a single format with two flavors — 650ml brown ale and 650ml white beer.

In the summer of 2022, 28-Day Fresh Beer was piloted in Foshan area. Despite its price as high as 15 yuan per can, it was sold out on the very first day. The top stores reached 200 even 300 yuan sales per day. The 28-Day Fresh Beer swiftly became another iconic exclusive best value product for Meiyijia, recruiting many new and better-off customers.

Illustration 9.11 Meiyijia 28-Day Fresh Beer

The Chinese fast-moving consumer goods (FMCG) industry is very complex and diverse, with 1.4 billion people spreading across 333 prefecture-level cities, 28,443 counties, and 38,724 villages and towns. It has many different consumption occasions and needs for individual, family as well as CBD. The strategy plan of Meiyijia is to cover all types of market and stores, hoping to reach 100,000 stores, covering from CBD in first-tier cites, communities in towns to even villages; from fresh food store, theme store, community store to even grocery store. The goal is grand and challenging. We will continue to explore how to land the goal with private label products.