One

Seize the trend

Great Wall Motors

taking the throne of Chinese SUV by pioneering and leading the trend

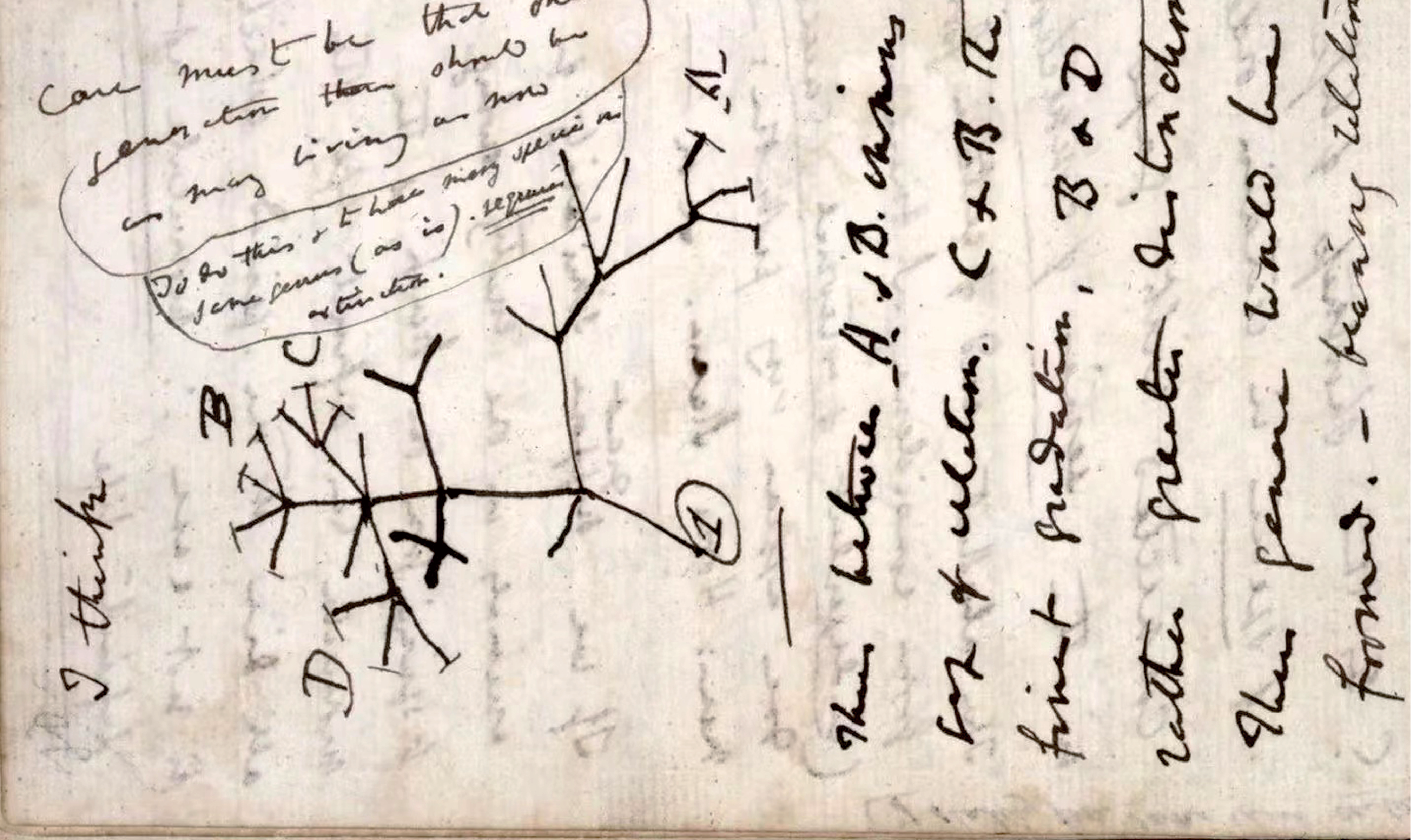

“Good decision makers know that decision making has its own process and its own clearly defined elements and steps. Every decision is risky: it is a commitment of present resources to an uncertain and unknown future. Making good decisions is a crucial skill at every level.”

⸺Peter Drucker

Illustration 1.1 Great Wall Motors Launching China’s First Economy SUV – Saifu SUV

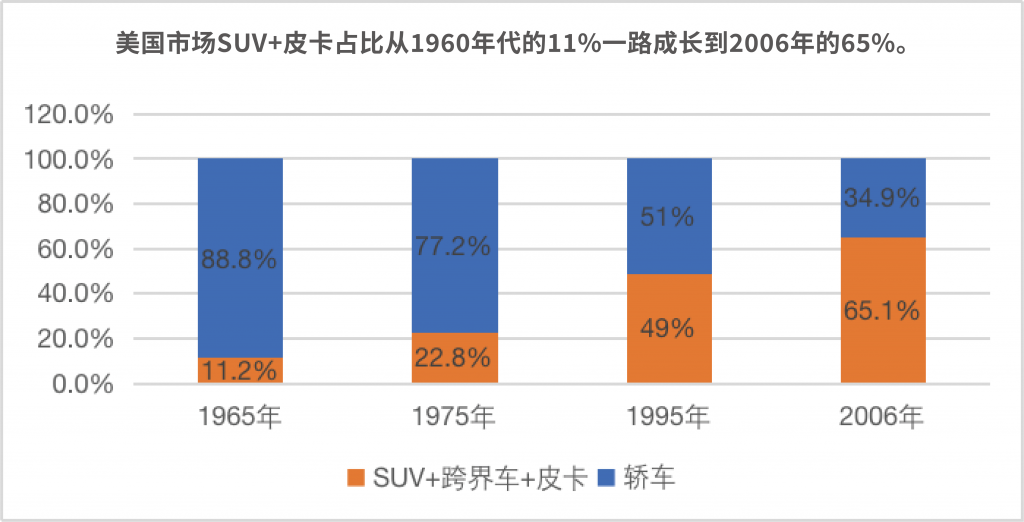

Illustration 1.2 The Development of SUV in the United States

Illustration 1.3 In 1989 Toyota Introduced its Compact SUV in the United States – Toyota RAV4

Illustration 1.4 Haval M1 launched in 2009

Illustration 1.5 Haval M2 launched in 2010

Illustration 1.6 Haval H6 launched in 2011

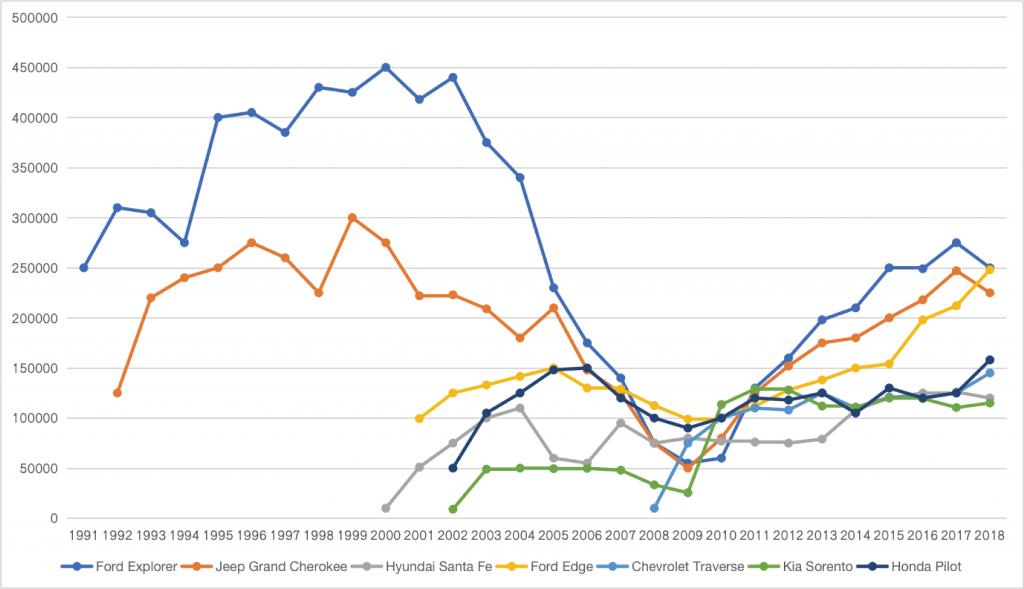

Illustration 1.7 The evolution of mid-size and full-size SUV in the United States

Source: Automobile Industry Analysis Report in the United States

Illustration 1.8 Tank launched in December 2020

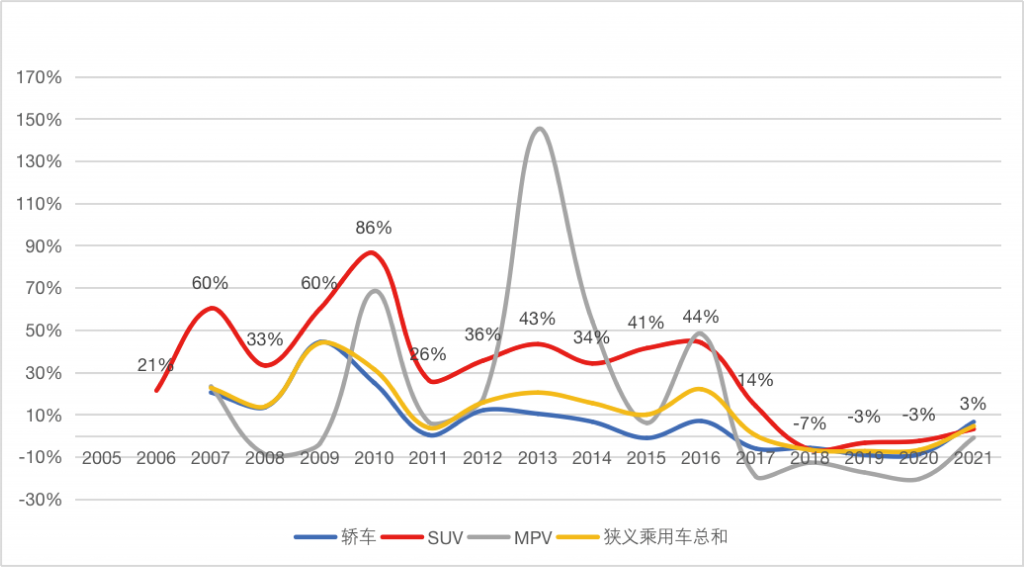

Illustration 1.9 Category Evolution of Automobile Industry in China

Source: China Association of Automobile Manufacturers

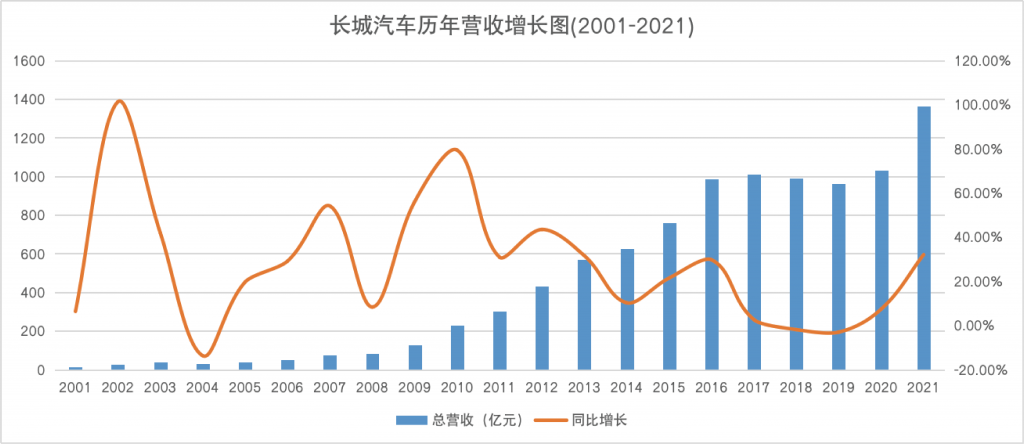

Illustration 1.10 The Revenue Growth of Great Wall Motors

Source: Annual Reports of Great Wall Motors