Three

Design growth plan

Jinmailang Beverage

conquering the packaged water market with the strategy of creating multiple growth curves

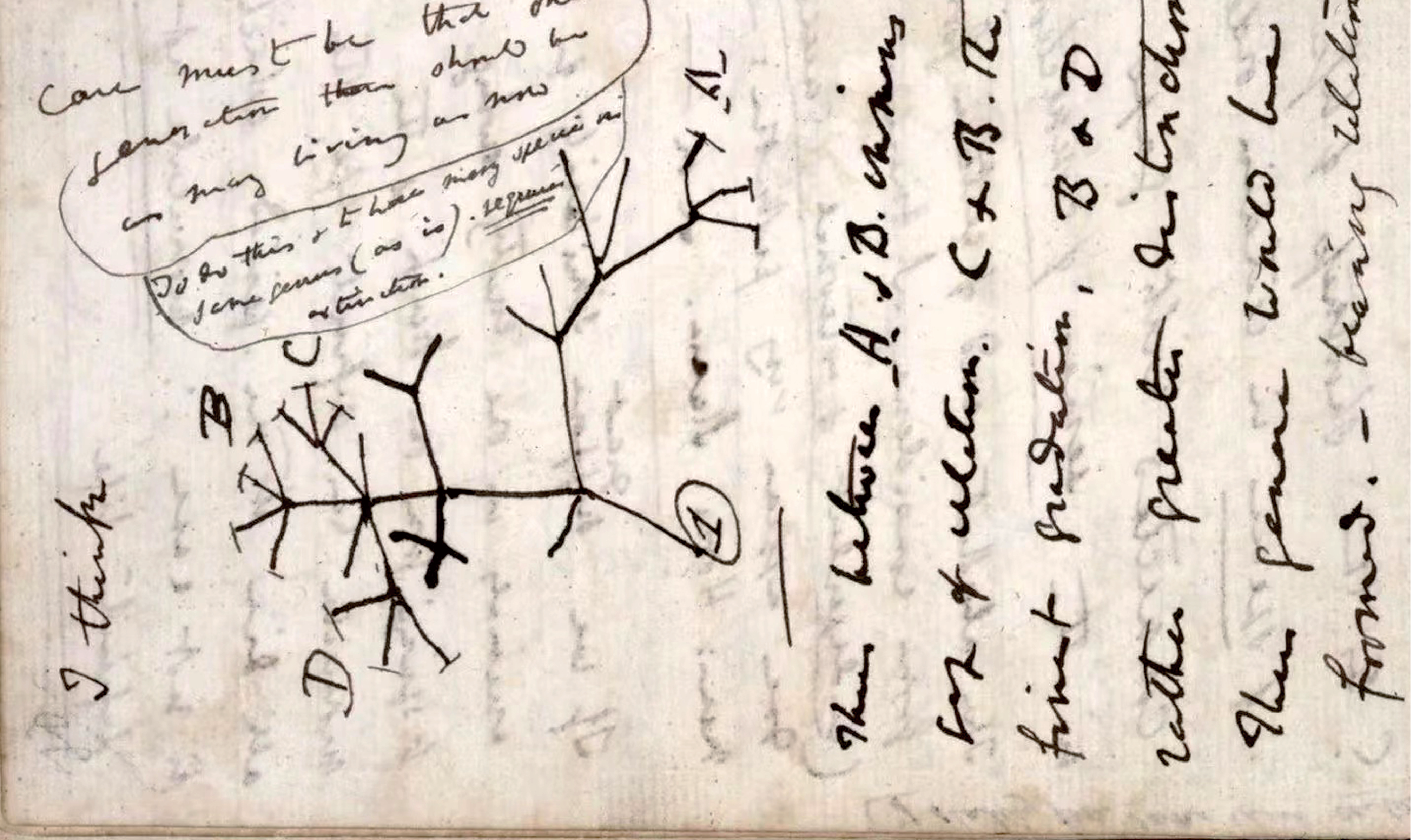

⸺Charles Handy

The methodology of seizing the trend is normally based on the research and study in industry development over the past dozens of years or even over one century. Choosing the right timing is normally based on three-to-five-year PEST (politics, economy, society and technology) analysis. Besides, company needs to have future blueprint and design growth plan for short-term, mid-term and long-term results.

Mr. Ren Zhengfei (CEO of Huawei) once said “If a technology is still two billion light years away, we may invest just a little money, like a sesame seed. If a technology is 20,000 kilometers away, we can invest a little more, like an apple. If a technology is just several thousand kilometers away, we will invest a lot more, like a watermelon. If a technology is just five kilometers away, we will invest heavily (a business version of a Van Fleet Load). We will rush towards and focus all of our efforts on this technology. We will expand it, and dive deeper into it. This way, we will be able to make world-leading products.” (Van Fleet Load, a term in the Korean War, meaning applying relentlessly powerful artillery fire to have extremely destructive impacts on the enemy, in order to defeat them quickly and productively, preventing any constructive defenses and reduce manpower loss as much as possible.) From five, several thousand, to 20,000 kilometers, eventually to two billion light years away; from Van Fleet Load, watermelon to apple, eventually to sesame seed, this is how to design growth plan.

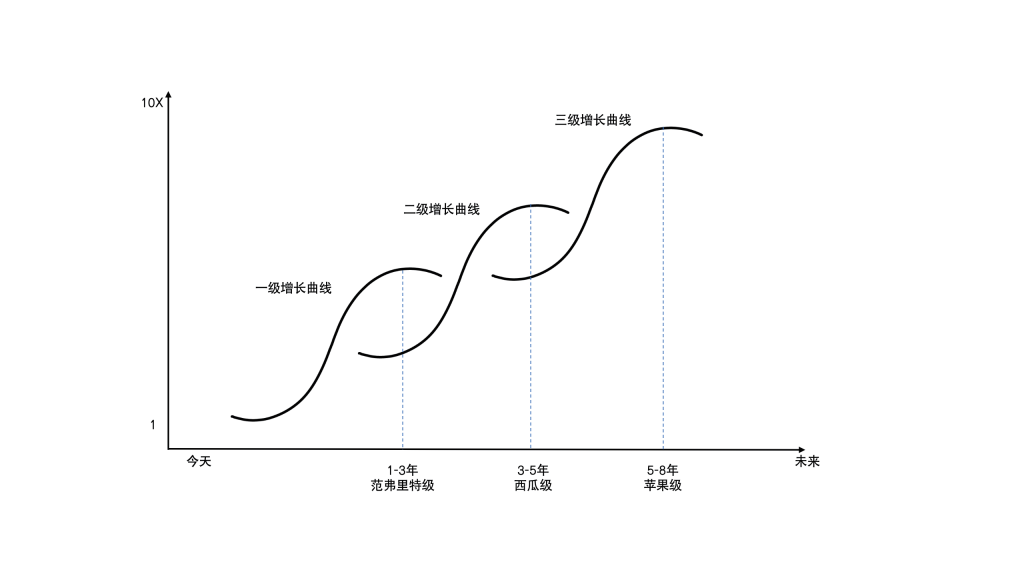

Illustration 3.1 Three Growth Curve Framework of Wang & Partners Innovation

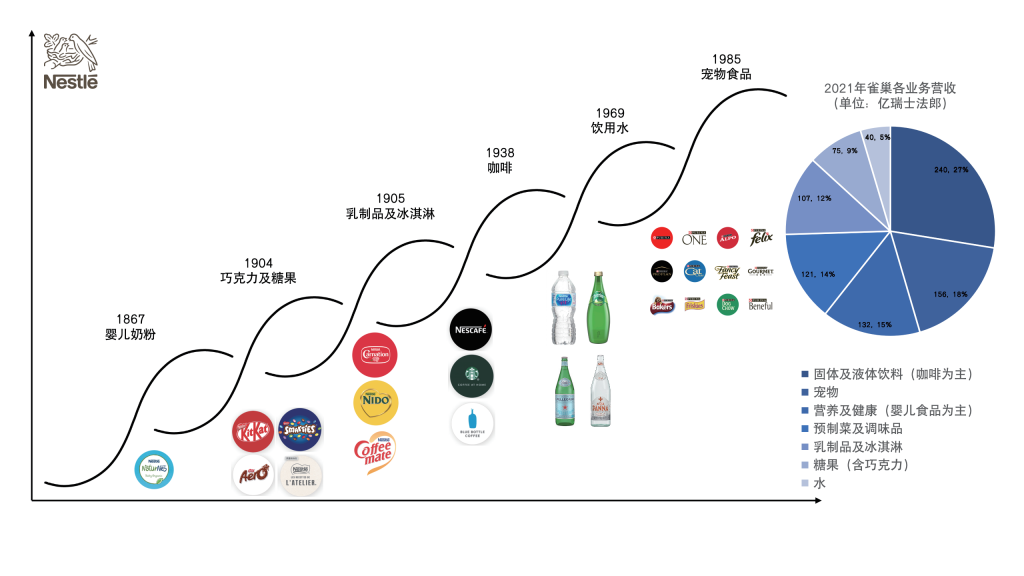

Illustration 3.2 Multiple Growth Curves of Nestlé

Note: Consolidation based on Nestlé official websites and annual reports

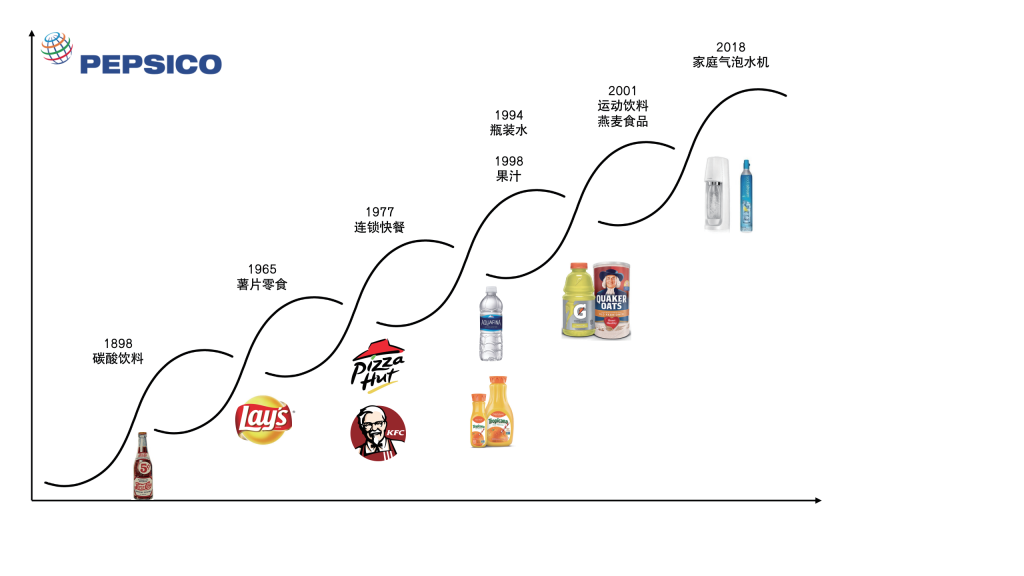

Illustration 3.3 Multiple Growth Curves of PepsiCo

Note: Consolidation based on PepsiCo official websites and annual reports

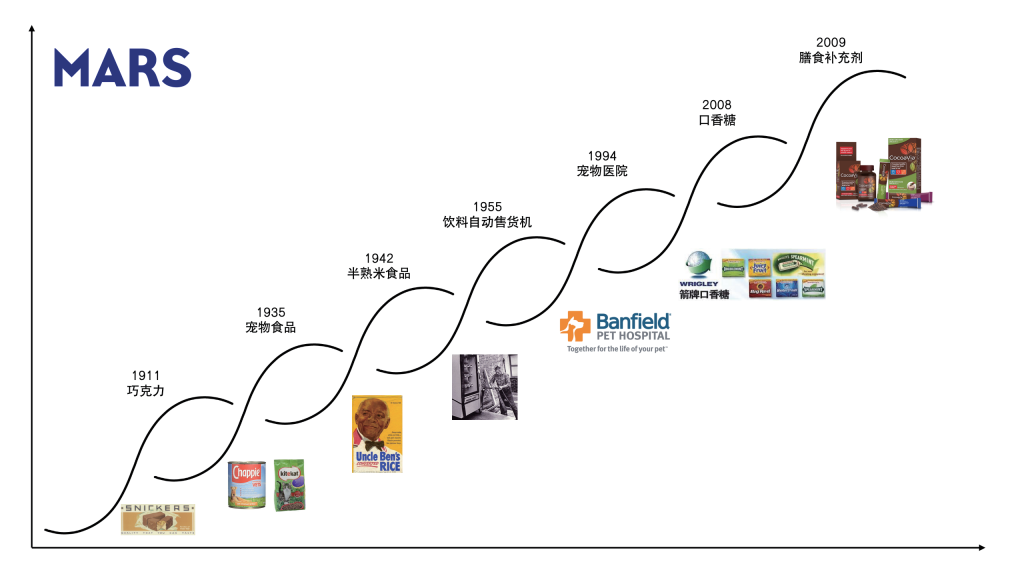

Illustration 3.4 Multiple Growth Curves of Mars

Note: Consolidation based on Mars official websites and annual reports

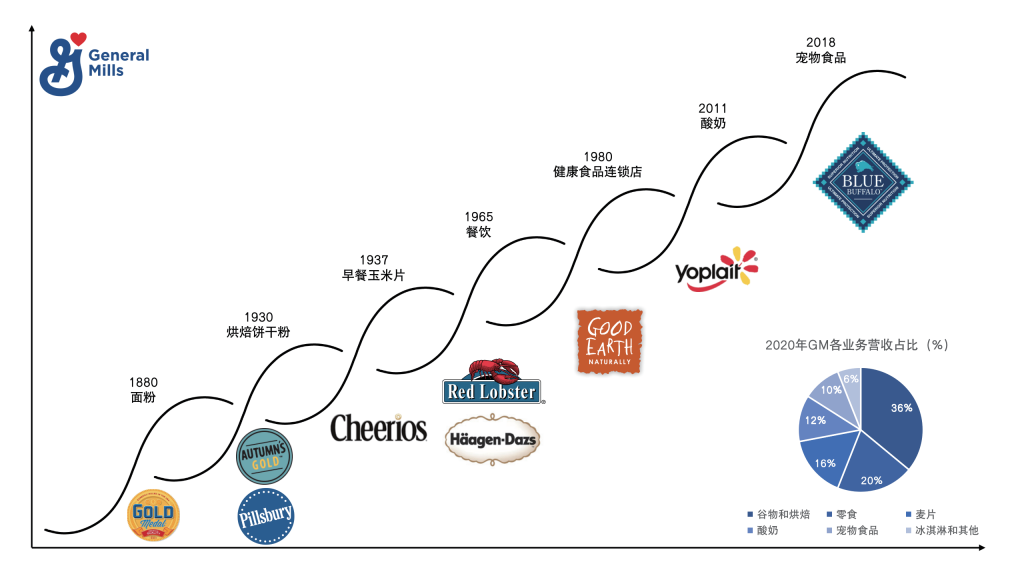

Illustration 3.5 Multiple Growth Curves of General Mills

Note: Consolidation based on General Mills official websites and annual reports

Bottled Water at 1 yuan – Promoting Trading Up in Drinking Water for Citizens

Among the trillion-value size (yuan) total beverages in China, the size of bottled water is over 200 billion yuan. Taking the United States as a reference, 100 billion yuan market size of bottled water consumed by 300 million population, which means that 1.4 billion population in China potentially can double the current size into over 400 billion yuan of bottled water.

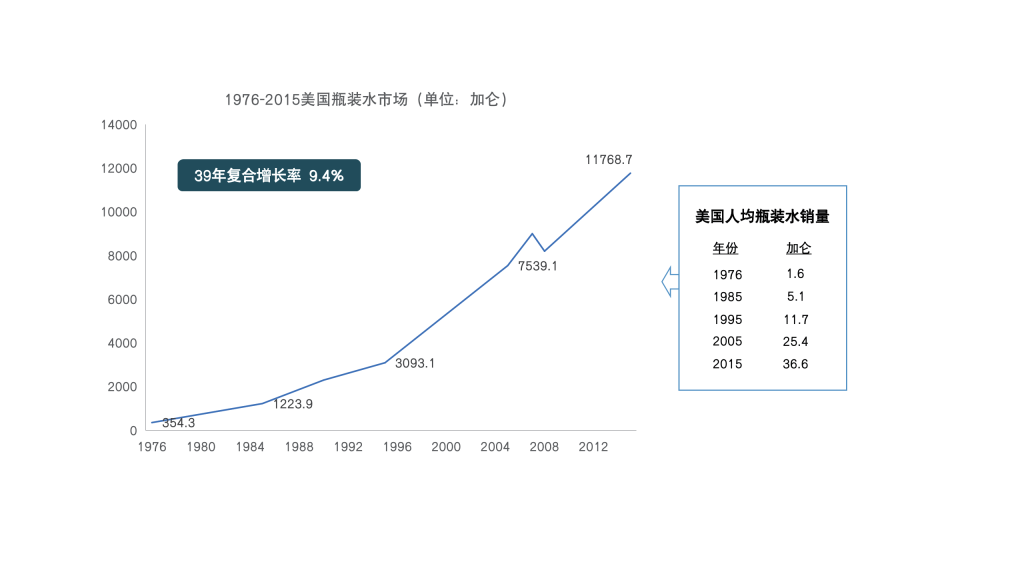

Illustration 3.6 Bottled Water Market Evolution over 40 Years in the United States

Source: United States Bottled Water Market Reports

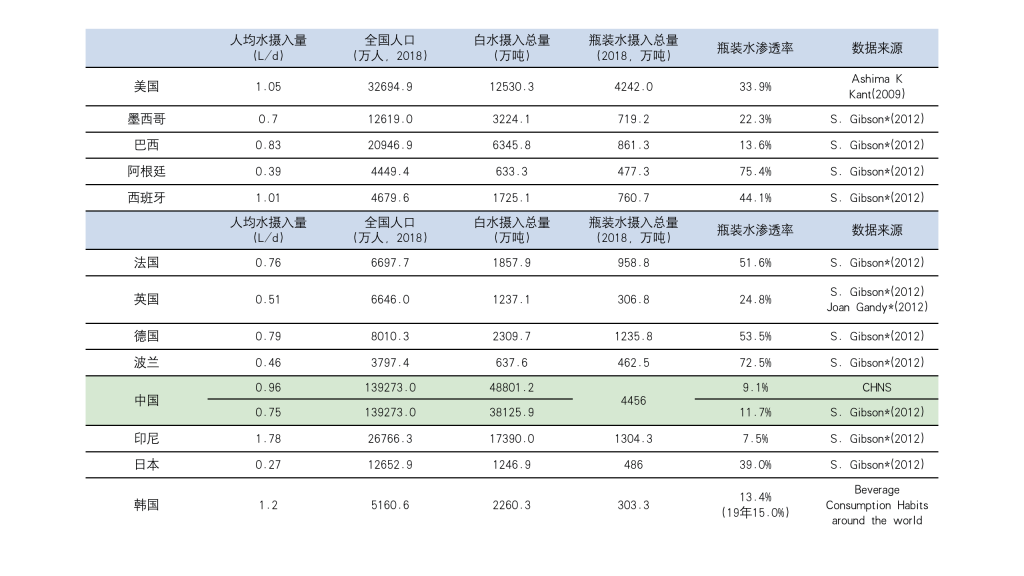

Illustration 3.7 Bottled Water Penetration across Countries

Source: World Bank, Euromonitor, Ashima K Kant (2009), Joan Gandy (2012), CHNS,

Guoyuan Securities

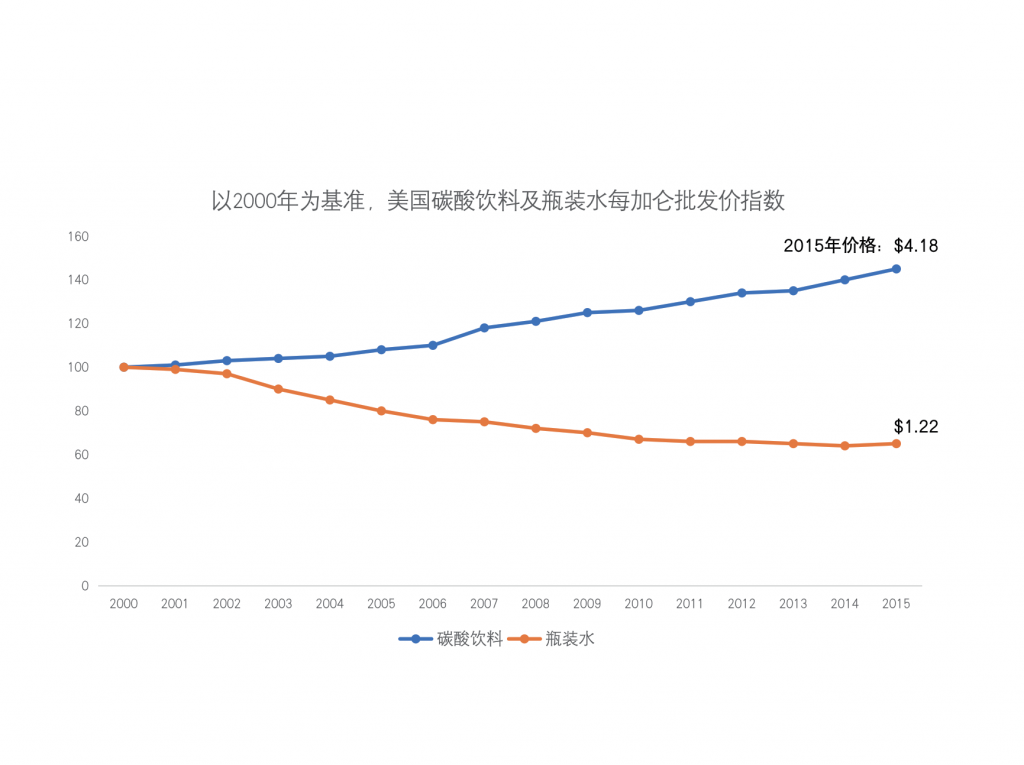

Niagara Bottling was founded in 1963. Currently, it is the largest bottled water manufacturer in the United States with a national volume market share of 25%. Niagara Bottling focuses on bottled water business since the very beginning. From 1963-1988, it was in the five-gallon jug water transportation business. In 1988, Niagara started its bottling business with one-gallon bottled water. Niagara began producing private label bottled water in the 1990s for grocery stores, clubs and supermarkets. In 1998, Niagara produced the lightest PET bottle in the United States with only 7 grams. Now Niagara owns over 20 bottling plants across the country and provides private label bottled water for retail giants such as Walmart and Costco. From 2000 till now, the average price per unit of bottled water in the United States has dropped 30%, Niagara is the main contributor.

Illustration 3.8 Bottled Water Price Evolution in the United States

Source: Beverage Marketing Corp.

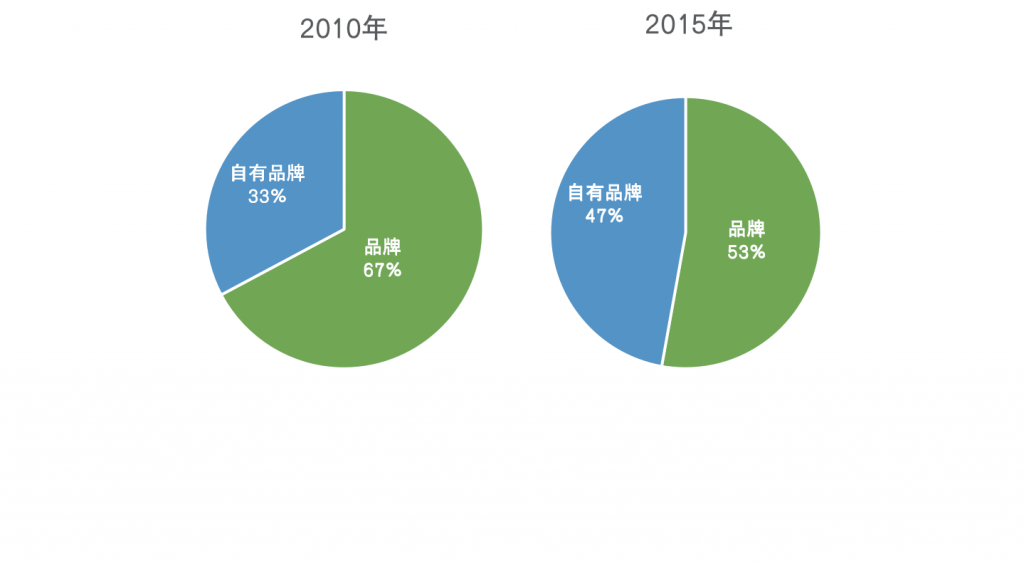

Illustration 3.9 Private Label Bottled Water Market Share in the United States

Source: United States Bottled Water Market Reports

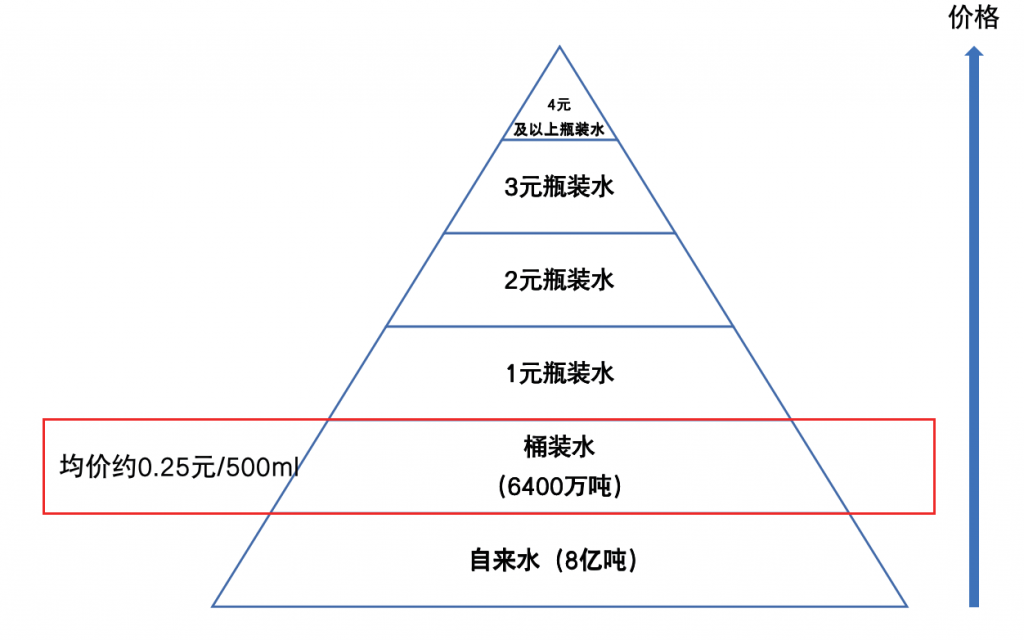

The mainstream price of bottled water in China is 2 yuan per bottle. Two manufacturers, Nongfu Spring and C’estbon, are leading mainstream segment with over 10 billion yuan revenues respectively. Nevertheless, under the trading up context of water consumption in China, the 1 yuan bottled water is still promising.

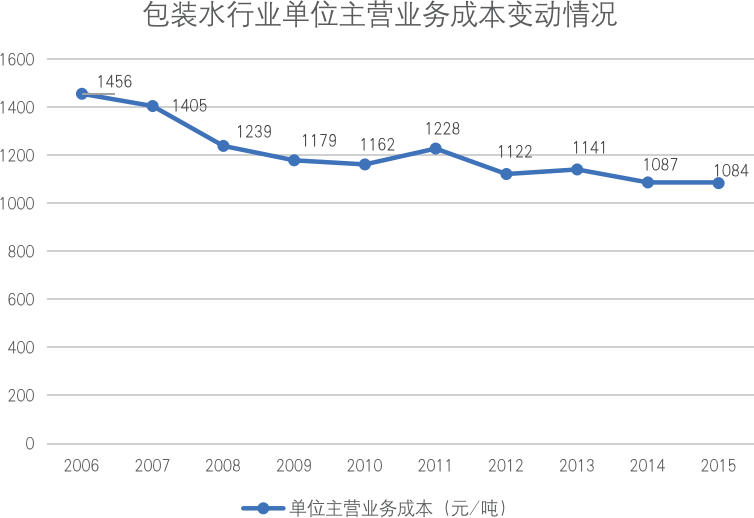

Illustration 3.10 Declining Cost of Packaged Water Causing Pricing Competition

Source: National Bureau of Statistics of China, Wind, Tianfeng Securities

Evolution of Unit Cost of Packaged Water Industry

Illustration 3.11 Low Price of Jug Water Trading Up into Bottled Water at 1 yuan/Bottle

Source: Public sources

With those insights, we advised Jinmailang Beverage increase investment in 1 yuan bottled water segment. Over recent years, Jinmailang has deployed multiple Krones high speed and automation filling lines. The productivity keeps increasing, from 70,000 bottles per hour to 90,000 bottles per hour, eventually to 100,000 bottles per hour with the latest generation facility. Meanwhile, Jinmailang created the unique water delivery model – water directly delivering to consumers, which significantly reduces the logistic cost. Providing good quality water at economy price has become the mission of Jinmailang Beverage.

In 2019, besides existing bottled water business, Jinmailang launched its business of private label bottled water for retailers. Within only three years, Jinmailang now has become the largest manufacturer of private label bottled water, which helps the rising and growing of Chinese retailers’ bottled water business. It ultimately reduces the cost of drinking water for consumers national wide.

Illustration 3.12 Jinmailang Soft Purified Water

Illustration 3.13 Hema Natural Water Manufactured by Jinmailang

Liangbaikai (Cooled Boiled Water), Pioneering and Leading in 2 yuan Cooled Boiled Water Segment

Bottled water selling at 2 yuan generates proper volume sales and decent profit margin. It is the must-win battle filed for almost all the bottled water manufacturers. With over twenty years persistence in natural water and public advocating, Nongfu Spring is leading this segment with almost 20 billion yuan revenues. C’estbon purified water is the No.2 player, with almost 15 billion yuan revenues.

Chinese people have the habit of drinking hot water since long time ago. In 1639, an Italian Jesuit priest Matteo Ricci wrote in his book On the Christian Mission among the Chinese by the Society of Jesus that “Chinese people like drinking boiled water. The habit is driven by the fact that boiled water is good for gut health. Generally speaking, Chinese has longer lifespan than European. They have high level of vitality even until 70-80 years old.” Apparently, this paragraph well describes the habit and perception of drinking water in China. Li Shizhen of Ming Dynasty noted something in his book Great Pharmacopoeia (Bencao Gangmu) called Taihe Soup, which is actually the boiled water, which has subtle taste, is good for recovery, helps blood flow, help to stay hydrated and quench the thirsty.

Inspired by the above learnings, Jinmailang introduced a new brand Liangbaikai (Cooled Boiled Water) to cater to the habit of drinking water of Chinese. The product is priced at 2 yuan per bottle (500ml), sitting in the category of boiled water to compete against the regular natural water and purified water represented by Nongfu Spring and C’estbon respectively. Within 6 years, the annual sales value of Liangbaikai has already reached two billion yuan. The success of Liangbaikai has drawn many leading national beverage manufacturers and local players follow suit, which help to increase the size of cooled boiled bottled water category to over 10 billion yuan. In a nutshell, Jinmailang started from scratch and created a 10-billion-yuan category.

Illustration 3.14 Jinmailang Liangbaikai

Illustration 3.15 Uni-President Liangbaikai

Illustration 3.16 Master Kong Hekaishui

Illustration 3.17 Nongfu Spring Baikaishui

Jinmailang Investing in Natural Mineral Water Selling at 3 yuan

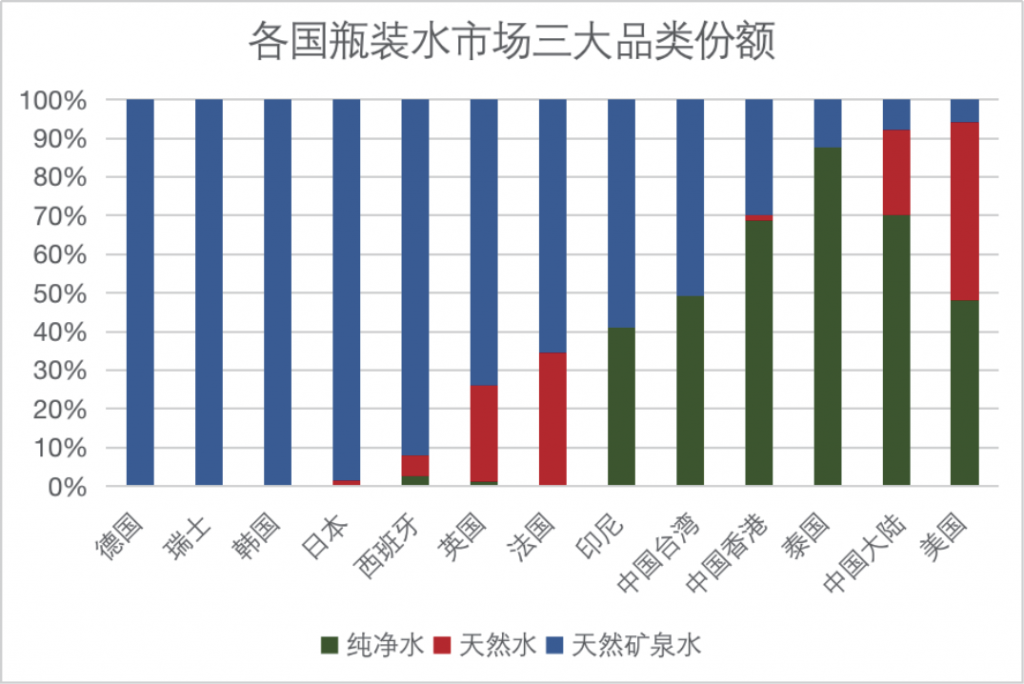

From the evolution of worldwide bottled water market, we can find out that the contribution of natural mineral water will get higher and higher as the economic situation getting better and better.

Illustration 3.18 Three Key Segments Contribution of Bottled Water Market Worldwide

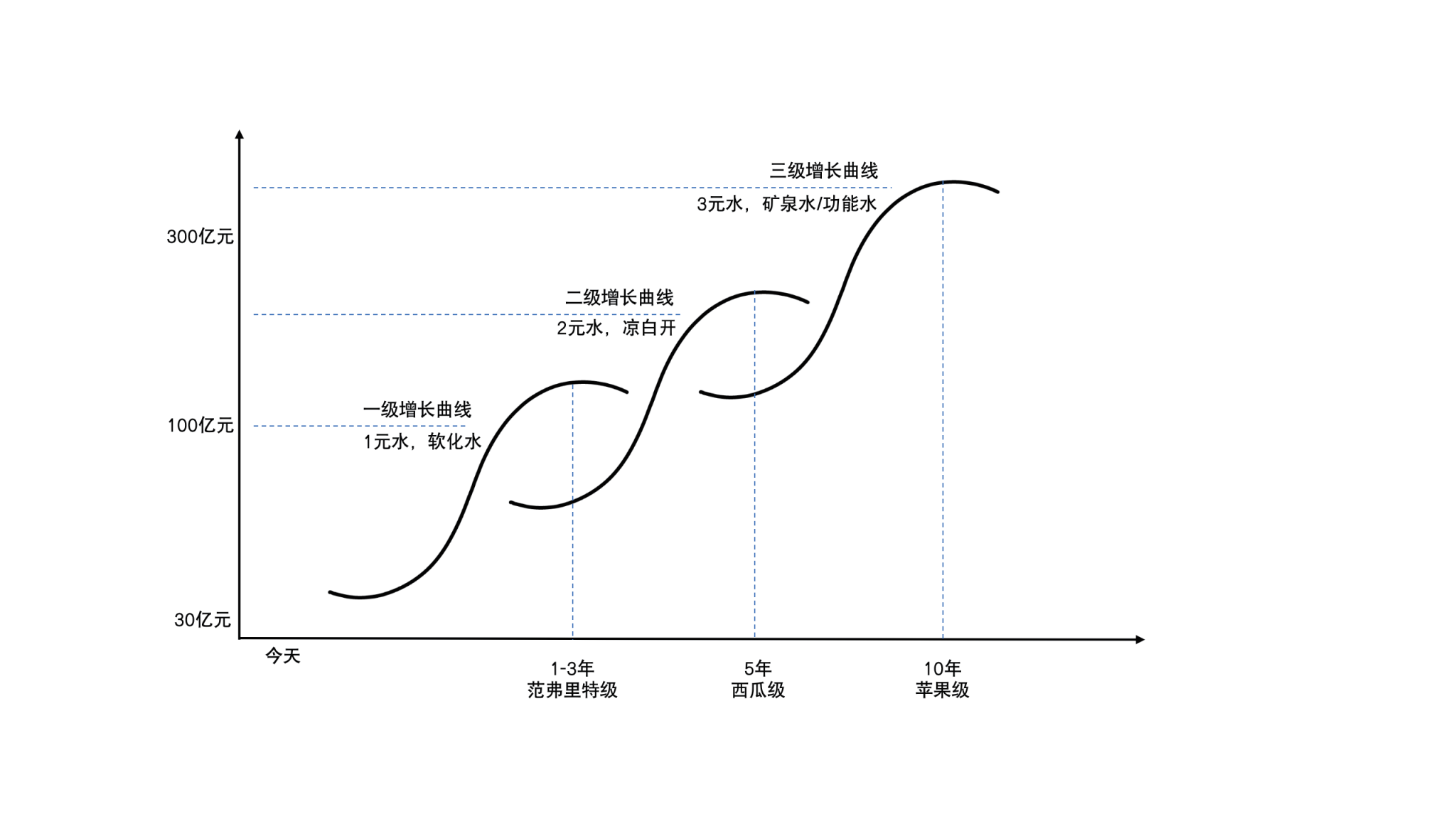

Jinmailang launched its own new brand of natural mineral water in early 2022, serving as the third growth curve to get prepared for the future.

Illustration 3.19 Three Growth Curves of Jinmailang Bottled Water